| Feature | LCG |

| Minimum deposit: | $1 USD |

| Withdrawal fee amount: | |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | |

| Spread from: | |

| Number of instruments: | |

| Year founded: | |

| Time to open account: | |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | |

| Products offered: |

Our LCG review was carried out by an expert trader examining the platform, costs, instruments and benefits of trading with LCG (London Capital Group).

LCG is a UK based broker with a 20-year track record of innovation and success. It offers traders the opportunity to trade over 7,000 markets using favourable trading terms and state of the art technology. Founded on a secure and well-regulated the firm offers top-class client support through its dedicated and knowledgeable team of staff.

The firm has won many awards over an extended period of time. Picking up recognition from third-parties such as Shares and Investors Chronicle illustrates how the LCG offering has an eye on appealing to traders looking for a broker that offers a great service but is also one that aims to instil trust.

LCG offer trading in over 7,000 global financial markets. This is at the top end of the range and means they offer some instruments which other brokers don’t. It’s possible to trade using CFDs, spread-betting and Swap-Free formats. Markets on offer are: forex, metals, indices, shares, commodities, options, cryptocurrencies, ETFs and bonds and interest rates. In line with standard practise standard accounts have leverage capped at 1:5 and 1:30 though professional clients can look to expand these limits.

The standard pricing is in-line with market norms but those looking to take advantage of what the LCG platform offers but shave some costs can look to upgrade to become a Professional grade client. Pricing on this account is as low as the zero pips bid-offer spread in EURUSD and USDJPY.

Those taking the step up to Professional will see other costs also drop as trading size increases.

Detailing the spreads and costs on so many markets and instruments is not an easy task but LCG embrace it and provide a concise and transparent breakdown of charges. Full details are available here:

https://www.lcg.com/uk/markets/spreads-costs/

Financing fees associated with holding a position might not get the attention they deserve. These frictional costs are part and parcel of trading and overlooking them can be the difference between profit or loss on a trade. Our reviewers were particularly pleased to see these charges clearly laid out and explained in simple language and with examples to follow. Such transparency is usually a sign that a firm is confident with where its pricing sits in the market and with LCG this is certainly the case. The overnight financing rate, sometimes referred to as a rollover charge or “swaps”, varies across different products. Indices and equity markets will use an underlying market financing rate, for example Libor in the UK, plus a charge of 2.5% (annualised).

Overnight financing for forex positions works slightly differently, as the applicable interest rate is calculated from the difference between the two base rates of the underlying currencies concerned, plus a charge of 1%.

What do you think of our LCG broker review so far? Do you have experience of trading with LCG? If so please let us know?

LCG offer client the choice of two top-grade platforms. Both of which are widely regarded across the industry. The main differentiation between the two products comes down to aesthetics and user preference and its to LCG’s credit that they offer their clients a choice.

The LCG Trader platform is supported by cTrader functionality. Its appealing aesthetic backed up up powerful charting and annotation tools. It supports extensive personalisation and customisation and allows for templates to be made of favourite charts. In the background there is a range of over 70 of indicators and oscillators. They are kept close to hand but in an unobtrusive way. Ensuring that traders can remain focused on the task in hand.

The functionality which allows addition and removal of indicators is particularly user-friendly. As is the ability to zoom in and out in the same chart/time-frame.

Given that the MT4 platform is the most popular retail trading platform in the world a lot of traders will already be familiar with the benefits of using it. Available in downloadable or web-browser based format, the LCG version of the platform offers the top grade execution, analytical tools and reliability which many have come to appreciate. The range of indicators is almost endless. The standard package includes over 30 charting tools such as Bollinger Bands, RSI, MACD, Stochastics, Moving Averages and Money Flow Index.

The Oscillators on offer are designed to allow traders to find the turning moments ahead of the actual move. Trend indicators help to assess the price direction and detect the turn moments and tend to operate as lagging indicators which confirm a price move.

Another benefit of the extensive MT4 ‘community is that there is an almost limitless range of third-party indicators on offer in the MQL5 online store. Many of these are also provided free of charge and the ones that do levy a charge are competing in a very tough market place which requires them to be worth the money if they are to thrive.

The MT4 dashboard can be customized to suit personal taste and the razor-sharp charting tools help it stand out when compared to some other platforms in the market which can sometimes appear a little ‘fuzzy’.

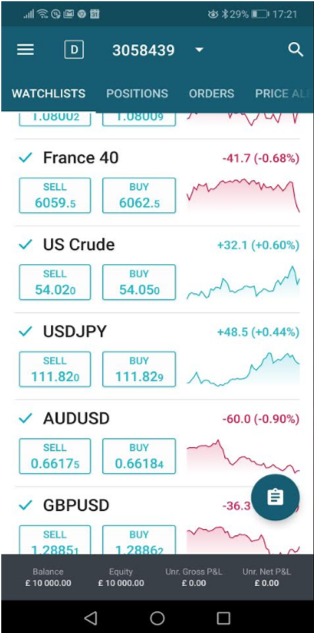

LCG offer mobile trading for those using iOS and Android devices. There is also a very useful tutorial which introduces clients to the mobile trading experience including how to use risk management tools on handsets.

Both the LCG Trader and MT4 platforms convert well to the mobile environment and carry over from the desktop format nearly all of the useful charting tools and indicators on offer there.

|

|

|

|---|

Charting analysis, one-tap trading and high-speed execution are all possible and particularly user-friendly for those uses who take a bit of time to build a watchlist. It is also possible to expand charts into full-screen mode to take advantage of maximum available screen space.

The Analysis & Research section of the site earns LCG bonus points. It offers a range of services specifically designed to support traders of all abilities. The Latest News section provides a summary of recent news events and offers pointers on how these could develop into trading ideas. Strategy planning is also helped by the Market Insight and Week Ahead videos which pick out upcoming events. These are of such value that the only criticism would be that it would be beneficial to clients if there were more on offer and if the Blog was updated more frequently.

LCG deserve credit for the high number of forex markets on which they offer detailed Technical Analysis. Their chart-based trading ideas cover on markets as varied as EUR/INR and TRY/JPY. As a lot of brokers and research sites tend to focus on major currency pairs the provision of user-friendly Technical reports in more diverse areas of the market is a neat feature and could open the door to trading opportunities.

More fundamental aspects of trading are also covered. The Glossary, Trading Guides and Trading Videos form a comprehensive package which is ideal for beginners but also has enough weight to be of use to more advanced traders.

As LCG offer more instruments than most other brokers its good to see they support traders develop an understanding of what the markets entail.

Ensuring that they cover all aspects of trader support LCG also offer Seminars and Webinars to their clients. These cover topics ranging from how to get the most out of the trading platforms to current market trends. As webinars are a very efficient means of improving understanding, LCG’s decision to offer them ensures traders are fast-tracked to being put in a position to trade the markets.

Customer support can be reached via Live Chat, telephone and email. Our testing established the service offered to clients was top-grade. Staff were informed and professional. Response times were super-fast and although not tested we did note that it’s possible to contact the brokers dealing desk direct should an urgent situation arise.

Most impressively the support is Available 24hrs a day and virtually 24/7 from 8am Saturday to 10pm Friday. This makes LCG one of the few brokers offering this level of coverage and would likely be of particular interest to traders who have a ‘day job’ and need to interact with broker support on weekends.

With over 4,000 brokers active globally, it’s good to share your experience with others. Spread the word on good or bad brokers. Disclaimer: Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. If you are unhappy with any comments, please email complaints @ wecomparebrokers.com

Important: You (the person writing the comment) are responsible for any comments you post and use this site in agreement with our Terms.