| Feature | Ayondo |

| Minimum deposit: | £200 |

| Withdrawal fee amount: | |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | |

| Spread from: | |

| Number of instruments: | |

| Year founded: | |

| Time to open account: | |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | |

| Products offered: |

Our Ayondo review is a constantly being updated.

Launched in 2009, Ayondo has grown out of its German base to now be a provider of Social Trading on a Global Scale.

It now has offices in London, Frankfurt, Madrid, Singapore and Zug and 43,000 active clients. To date, it has won 19 international awards and the achieved these by following the seemingly simple aim of connecting investors with Top Traders. One of the smaller operators in the space it has successfully carved out a niche in the sector and attracts investors looking for quality and service.

The bid-offer spreads offered by the self-trading area of the Ayondo platform are in-line with the average for the sector.

On the Social Trading area of the platform, there are two pricing models that apply to accounts following a Top Trader. Some use a Volume Based pricing structure and the others use a Performance-Based approach.

Spoiler Alert! Whilst registering for accounts we found a few glitches in the Ayondo site. These are noted below in the Ease of Use section; but once we did get past the on-boarding stage the Ayondo platform was a real pleasure to use.

The mobile trading platform seamlessly mirrors the desktop version. Available through dedicated Apps or browser windows it’s fast, intuitive and easy to use. All the features found on desktop are on the mobile version.

Ayondo provides a similar amount of research and learning materials to other smaller brokers. Whilst they are no means market leaders there are sections along the lines of ‘How things work’, FAQs, Glossary and webinars. There is also a Calendar function (‘Useful Dates’) and TradeHub features a 24/7 newsfeed.

The amount of research and learning is disappointing. Considering that Ayondo has some unique selling points we are sure they could do better in this area. One improvement would be developing an online forum where investors and traders could share ideas on trading and the markets.

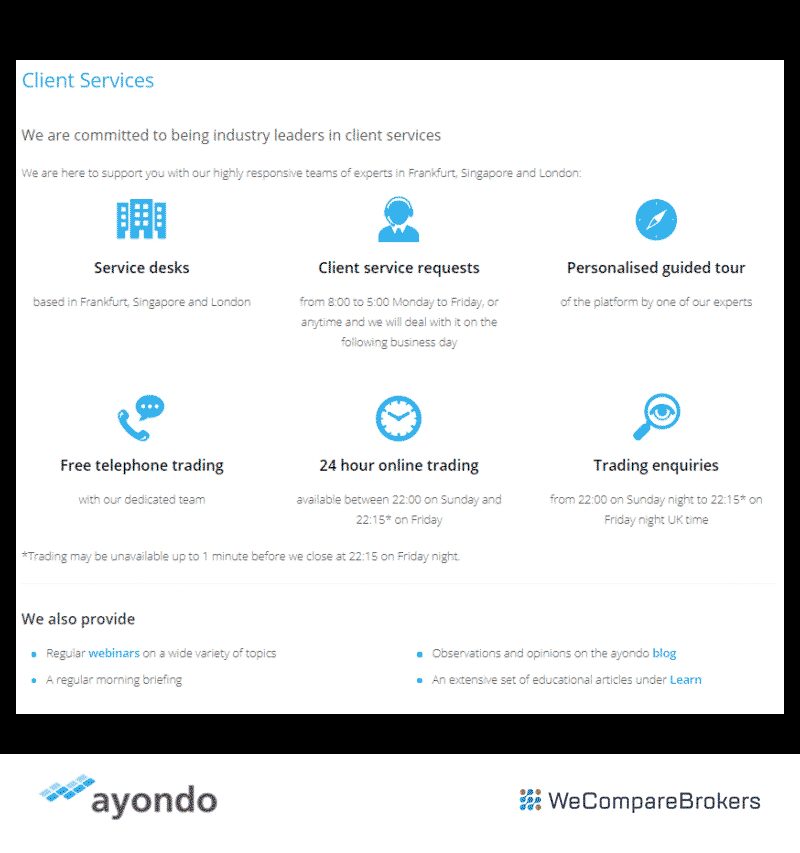

During our testing, we found the customer support to be of exceptionally high quality. Telephone help desk staff understood and addressed our issues with ease. Something that Ayondo offer and a lot of other brokers doesn’t is a Remote Access Tool.

Whilst telephone trading support is available on a 24/5 basis the actual help desk is manned during office hours Monday – Friday. Our experience of this kind of coverage is that any questions that occur in the middle of the night can usually be resolved by the ‘trading desk’ who offer a general as well as trading support. Technically speaking though, help desk support is only offered during office hours and this counts against Ayondo.

With over 4,000 brokers active globally, it’s good to share your experience with others. Spread the word on good or bad brokers. Disclaimer: Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. If you are unhappy with any comments, please email complaints @ wecomparebrokers.com

Important: You (the person writing the comment) are responsible for any comments you post and use this site in agreement with our Terms.